The Evolution of Money Counting Machines

Introduction

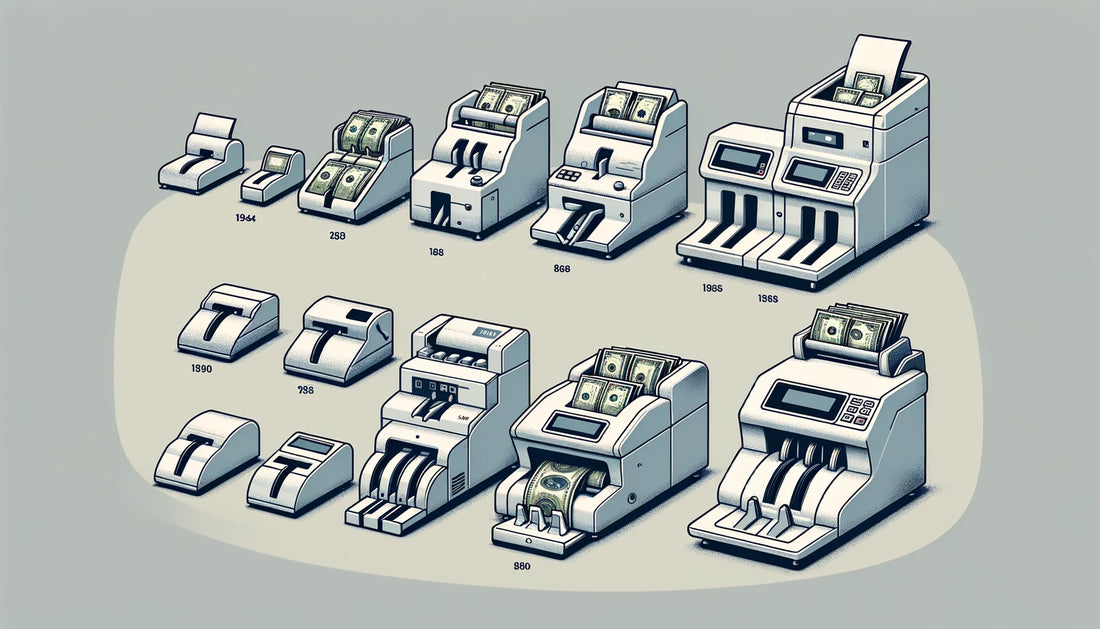

The journey of money counting machines from rudimentary mechanical counters to today's highly sophisticated devices encapsulates a fascinating evolution of technology. Initially developed to aid businesses in managing large volumes of cash efficiently, these machines have become indispensable tools in financial operations across various industries. This blog explores the significant milestones in the development of money counting machines, their impact on business practices, and the technological advances that have shaped their current functionalities.

The Early Beginnings of Money Counting Technology

The genesis of money counting machines can be traced back to the early 20th century when the first mechanical devices were invented to count coins. These early machines were simple in design and function, primarily relying on manual operation to tally amounts. They served as crucial aids for businesses that dealt with large transactions daily, reducing human error and saving time. As the demand for faster and more reliable counting increased, the evolution of these machines took a pivotal turn towards more automated solutions.

Advancements during the mid-20th century introduced the first electronic money counters. These devices were capable of counting larger volumes of cash with greater accuracy and speed than their purely mechanical predecessors. The introduction of electronic components laid the foundation for further innovations that would revolutionise the design and functionality of money counting machines.

Technological Advancements in the Late 20th Century

By the late 20th century, money counting technology had advanced significantly, with the incorporation of features such as batch counting and size detection, which allowed for more versatility in handling different types of currencies and denominations. The period from the 1960s to the 1990s witnessed rapid technological growth, with money counters becoming increasingly compact and user-friendly. This era also saw the introduction of programmable functions, enabling users to customise operations according to their specific needs.

These advancements not only improved the operational efficiency of money counting machines but also enhanced their reliability and accuracy. Businesses could now manage their cash with unprecedented precision, leading to better financial control and reduced discrepancies in cash handling processes.

Also See:

Introduction of Counterfeit Detection

One of the most significant developments in the evolution of money counting machines was the integration of counterfeit detection technologies. Initially, these features were rudimentary, often based on simple magnetic or metallic detection techniques. However, as counterfeiting methods became more sophisticated, the technology in money counters had to evolve correspondingly.

Modern money counters are equipped with advanced detection systems that use ultraviolet (UV), magnetic (MG), and infrared (IR) sensors to scrutinise the authenticity of notes. These technologies not only detect counterfeit bills but also contribute to the overall security of cash transactions. The ability to automatically verify the authenticity of cash has made these machines vital in the fight against financial fraud and counterfeiting.

The Role of Microprocessors

The integration of microprocessors marked a revolutionary step in the development of money counting machines. Microprocessors enabled enhanced control over the machine's functions, allowing for faster processing speeds and more complex operations. This technology brought about the ability to sort, count, and even archive transaction data, providing businesses with detailed insights into their cash flow.

Microprocessors also facilitated the development of multi-currency counters that could recognize and tally notes from different countries, making them indispensable in a globalised economy. The precision and adaptability provided by microprocessor-driven money counters have significantly improved the operational efficiency of many businesses, particularly in environments where handling multi-currency transactions is common.

The Impact of Digitalisation on Money Counters

The digitalisation of money counting machines has led to significant improvements in functionality and interconnectivity. Today's devices can seamlessly integrate with point-of-sale (POS) systems and financial software, providing real-time data syncing and comprehensive financial reporting. This integration helps businesses streamline their operations and maintain more accurate financial records.

Moreover, digitalisation has introduced user-friendly interfaces and touch-screen controls, making these machines easier to use and more accessible to a broader range of users. The ability to update software remotely ensures that money counting machines can adapt to new currencies and counterfeiting techniques, further enhancing their utility and lifespan.

Money Counters in Retail: Streamlining Operations

In the retail sector, money counting machines have become crucial in optimising cash management processes. These devices expedite the end-of-day reconciliation processes and significantly reduce the time staff spend counting cash. This not only streamlines operations but also minimises the chance of errors, ensuring that the financial records are accurate and reliable.

Moreover, in high-volume retail environments, money counters can help in setting up multiple till points with exact starting cash, making shift changes smoother and more efficient. The time saved by automating these processes can be redirected towards customer service and other core business activities, enhancing overall productivity and customer satisfaction.

The Financial Sector’s Reliance on Automated Counters

Banks and other financial institutions have been among the primary beneficiaries of advancements in money counting technology. In these environments, the accuracy and efficiency of cash processing are paramount. Automated money counters enable banks to handle large volumes of cash quickly and accurately, reducing queues and improving customer service.

Additionally

, these machines play a critical role in back-office operations, where they are used to prepare bank deposits and balance ATMs. The high standards of reliability and accuracy required by the financial sector have driven continuous improvements in money counting technology, making these devices more sophisticated and reliable over time.

Customisation and Adaptability in Money Counters

The ability to customise money counting machines to meet specific operational requirements is a key factor in their widespread adoption. Businesses can choose from a range of models that vary in size, capacity, and functionalities, such as mixed denomination counting or detailed reporting features. The adaptability of these machines ensures that they remain relevant and valuable even as a business grows and its needs change.

Furthermore, manufacturers have responded to market demands by offering modular designs that allow for easy upgrades and additions. This adaptability not only extends the life of the machines but also ensures that they continue to provide value by adapting to changing business environments and technological advancements.

Recent Innovations in Money Counting Technology

The latest innovations in money counting technology include the introduction of wireless connectivity and cloud-based data management. These features allow businesses to manage cash across multiple locations centrally, providing greater oversight and improved data accuracy. Wireless technology also facilitates the easy sharing of data between machines and central systems, enabling more dynamic cash management strategies.

Touchscreen interfaces and user-friendly software have made these devices more accessible to employees with varying levels of technical skill. Additionally, some newer models incorporate features like serial number tracking, which assists in more detailed financial auditing and tracking of cash flow.

Money Counting Machines and Regulatory Compliance

In an era where financial transparency and compliance with regulatory standards are more critical than ever, money counting machines play a vital role. These devices help businesses adhere to stringent anti-money laundering (AML) laws by providing accurate and traceable counting records. The ability to log and report transactions automatically makes it easier for businesses to provide the necessary documentation for audits and compliance checks.

Moreover, the precision of modern money counters ensures that businesses can maintain compliance with tax regulations and other financial reporting requirements, safeguarding against financial discrepancies and the legal issues that can arise from them.

The Future of Money Counting Technology

Looking ahead, the future of money counting technology appears poised for further innovations, driven by advances in artificial intelligence (AI) and machine learning. These technologies promise to enhance the capabilities of money counters, potentially enabling features like predictive maintenance, enhanced counterfeit detection, and even greater integration with business intelligence systems.

As digital currencies and payment methods continue to evolve, money counting machines will likely adapt to handle these new forms of transactions, maintaining their relevance in a rapidly changing financial landscape.

Conclusion

The evolution of money counting machines from simple mechanical counters to complex digital systems illustrates the profound impact of technological advancement on business operations. As these devices continue to develop, their role in enhancing operational efficiency, ensuring financial accuracy, and complying with regulatory demands will only grow stronger. The future developments in this field are eagerly anticipated, with expectations of even greater efficiency and integration capabilities.